san francisco payroll tax calculator

Although most states have their own versions of a quarterly tax. If you make 55000 a year living in the region of California USA you will be taxed 11676.

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

. Ad Process Payroll Faster Easier With ADP Payroll. At quarter end we will prepare and electronically submit the 941 Federal Payroll tax return and the applicable states returns. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Proposition F fully repeals the Payroll Expense.

From imposing a single payroll tax to adding a gross receipts tax on. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Youll pay this state unemployment insurance tax on the first 7000 of each employees wages each yearup to 434 per employee in 2019.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Proposition F fully repeals the Payroll Expense. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll.

Name A - Z Sponsored Links. Our payroll tax services are available in and around the California Bay Area North Bay South Bay and East bay including San Francisco. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the.

Use the Free Paycheck Calculators for any gross-to-net calculation need. Ad Payroll So Easy You Can Set It Up Run It Yourself. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Although this is sometimes conflated as a personal income tax rate the city. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Get Started With ADP Payroll.

Payroll Tax Calculator in San Francisco CA. State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their. ASR Tax Financial Services.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. This provision does not apply to annual earnings in excess of 123000. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2022 Free.

Payroll Tax Calculator in South San Francisco CA. California unemployment insurance tax. Name A - Z Sponsored Links.

Discover the payroll service youve been searching. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. Payroll Expense Tax.

That means that your net pay will be 43324 per year or 3610 per month. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. All Services Backed by Tax Guarantee.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Important note on the salary paycheck calculator. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are.

Tax Return Preparation Accountants. Your employer withholds a 62 Social Security tax and a.

Transfer Tax Calculator 2022 For All 50 States

Rental Property Returns And Income Tax Calculator

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

New Data Calculating The Living Wage For U S States Counties And Metro Areas

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Federal Income Tax Return Calculator Nerdwallet

How To Calculate Additional Medicare Tax Properly

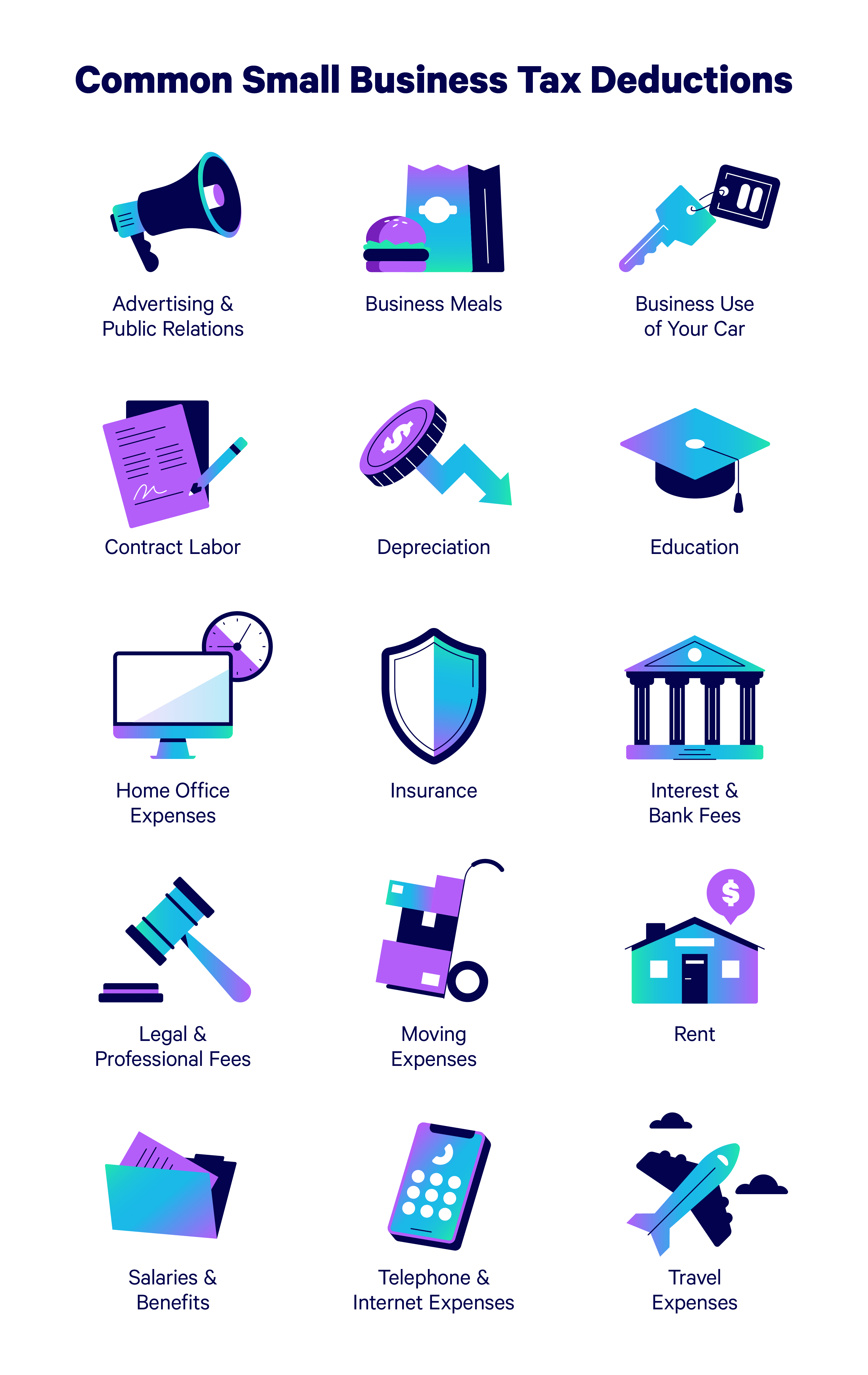

Free Llc Tax Calculator How To File Llc Taxes Embroker

Self Employed Income Calculator Tax Expenses Calculator

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

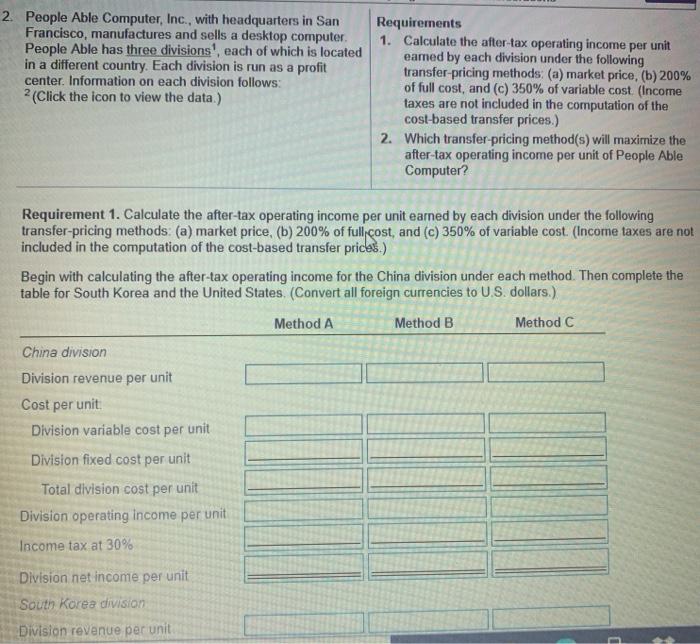

Solved 2 People Able Computer Inc With Headquarters In Chegg Com

Rental Property Returns And Income Tax Calculator

What Do Nfl Players Pay In Taxes Smartasset

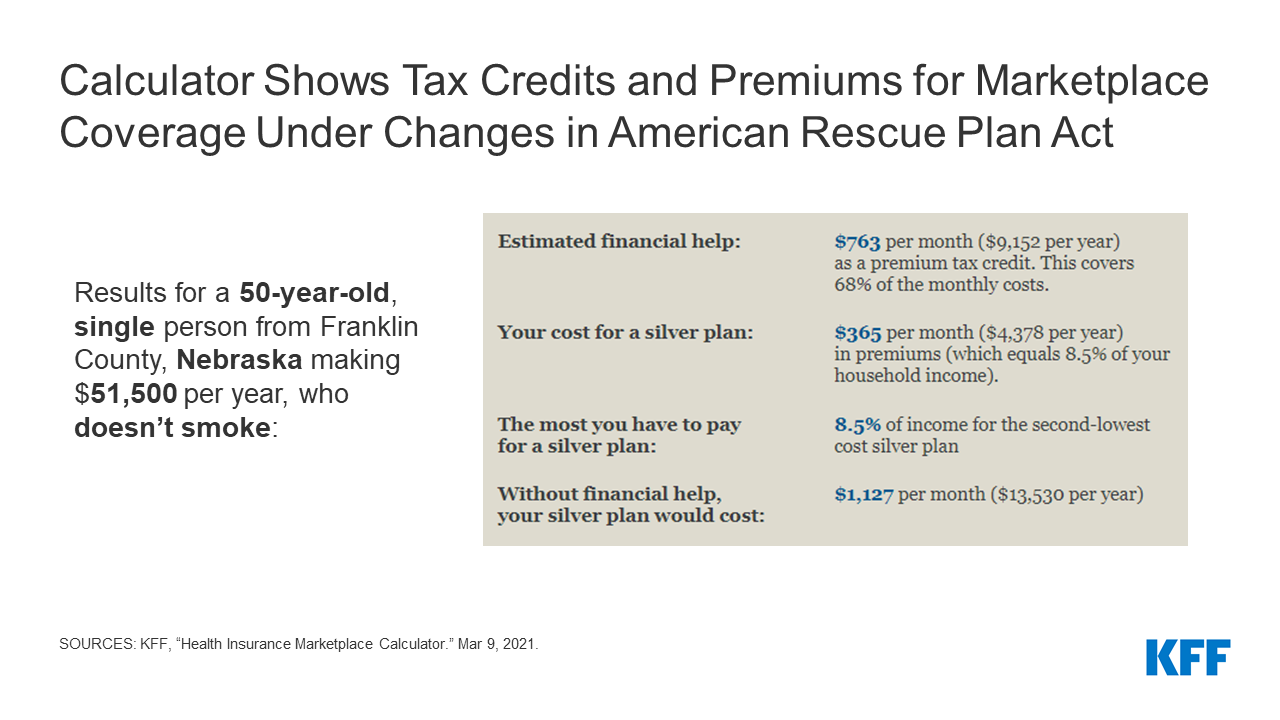

Updated Kff Calculator Estimates Marketplace Premiums To Reflect Expanded Tax Credits In Covid 19 Relief Legislation Kff

Salary Paycheck Calculator Calculate Net Income Adp

State Payroll Taxes Guide For 2020 Article

Should You Move To A New City To Increase Your Income Four Pillar Freedom

How Much Should I Save For 1099 Taxes Free Self Employment Calculator